Budgets are for more than just organized moms, or penny pinching students…well they really do help penny pinching students if you’re asking one.

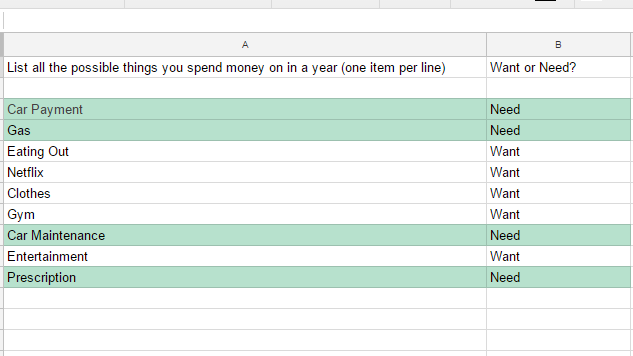

We were asked to make a list of wants and needs that’s we spend in a year. It was in this moment that I realized I spent my small paycheck on more wants than I do on my actual needs. Now perhaps this is because I am seventeen, still in high school, and I live under my parents protective wing, so there is not much I need to pay for in terms of necessities. As well, the things I considered needs, aren’t necessarily needs for other people.

I consider my car a need because I live far enough away from my school that I no longer receive a school bus, there is no public transportation, my family has too busy of a schedule to be toting me around, and I have too many places to be to be taking a cab every time. Thank goodness that I only have one other need.

Next we had to figure out an example of how to use the equation to find out how much we make in a year, after tax deductions, and then figure out how much we spend on our wants and how much we could be saving if we cut back on them.

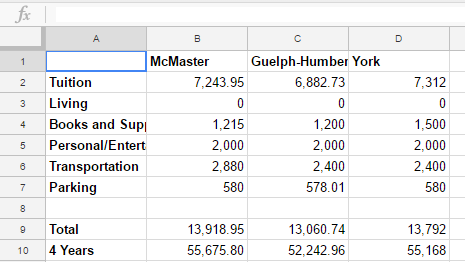

I especially realized just how much money I could be saving, should I create an appropriate and reasonable budget for my lifestyle. As we enter into the university world, there will be so many new changes. I am not staying in residence so I will still have my part time job, but no where near the same about of hours. Cutting back to two shifts a week will bring my paycheck down by about half, which is where I need to get my priorities straight. Considering I will be adding 10 minutes to my commute one way, I will be spending more on gas. This is where spending more than you can afford to really comes into play. My car will still be a need for me, so I need to reinforce my budget, and cut back in other areas.

Maybe I’ll quit the gym, and use the one at my future school, or eat out less and instead start cooking more home cooked meals. The point I’m trying to make here, is that having a budget is like having a financial plan. When it comes to the big purchases (house, car, travelling), your budget should be well thought out and also realistic…let’s not forget followed through with.

I anticipate myself using one throughout my young adulthood and even into my future as a way to prepare myself for the bills that will be rolling through, and to not be shocked at my spending.